Ahead of the curve: Resilience amid divergence

admin 2024-05-30 15809

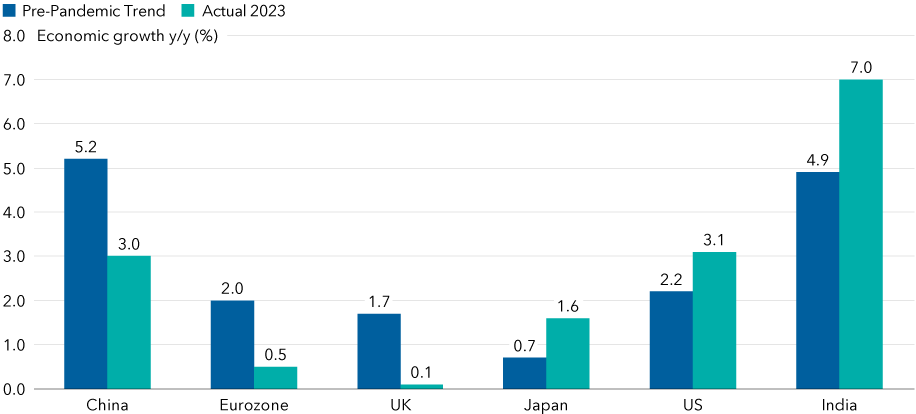

While economies have proved remarkably resilient in the face of aggressive interest rate hikes, we have started to see divergence more recently. Countries such as the US, India and Japan have proved stronger than others – including Europe, the UK and China – driven mainly by differences in consumption, investment, and fiscal policies.

In the absence of reforms, or an increase in productivity, cyclically more fragile economies would likely stay fragile, while the more resilient will continue that way over the longer term.

This will have an impact on asset prices, with more resilient economies expected to have higher rates across the curve, a greater degree of financial stability and tighter credit spreads. The opposite applies to more fragile economies, which cannot sustain higher rates alongside weaker nominal growth and lower financial stability.

Comparison of real GDP growth in 2023 and pre-COVID trend

Source: OECD as of 16 February 2024, National Statistics. Capital Strategy Research (CSR) estimate for China.

Overall, this remains a very supportive backdrop for fixed income. At present, the benign macroeconomic environment in the US is supportive of credit risk and the anticipated pivot by central banks should support duration.

As divergence between economies increases, the opportunity to diversify risk is likely to rise as dispersion between different areas of the bond universe increases. Globally, attractive opportunities can now be found in investment grade, emerging markets, high yield and government bonds.